Customer Marketing and Engagement

Prominent Life Insurance Provider

Customer Engagement and Sales Automation Platform

A leading life insurer faced rising acquisition costs, low lead conversion, and fragmented engagement across digital and offline channels.

Manual campaign design and inconsistent incentives led to disjointed experiences, weak cross- selling, and slower policyholder growth.

Core Problems Solved

AI Transcend deployed an AI-powered customer engagement and sales automation platform that unifies multi-channel data to deliver personalized, data-driven insurance marketing. The solution boosts lead conversion, cross-selling, and retention while reducing operational costs and driving measurable revenue growth.

Key Features of the Solution

-

Intelligent

Activity System

-

Big Data

for Marketing

-

Sales

Empowerment Tools

Achievements and Benefits

10x Increase

Campaign Throughput:

Campaign deployments increased by 10x through templated activities and automated workflows.

50%+ Conversion Increase

Enhanced Lead Conversion:

New lead conversion saw a 50% increase due to targeted triggers and personalized follow-ups.

230% Uplift

Significant Cross-Sell Uplift:

Interest-based recommendations boosted related product sales by more than double.

25% Reduction

Reduced Churn Rate:

AI-driven prediction models and retention offers successfully cut policy lapses by one quarter.

Transform Your Insurance Operations

Ready to transform your life insurance customer engagement and drive significant growth? Connect with our insurance industry specialists to explore how AI Transcend can deliver measurable ROI and competitive advantage for your operations.

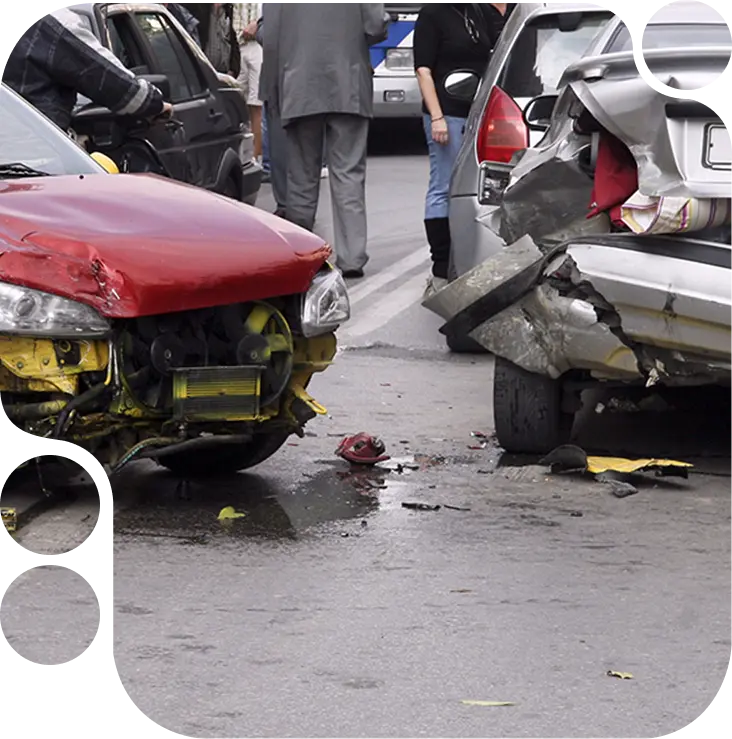

Intelligent Loss Assessment & Quick Compensation

Premier Property Insurer

Claims Processing and Fraud Detection System

The property insurance industry is under mounting pressure to manage claims more efficiently, reduce fraud, and enhance customer satisfaction.

Manual vehicle damage assessments achieved only 60% accuracy and took 2– 3 days per claim, while rule-based fraud checks missed 30% of fraudulent cases, driving up costs and delays.

Core Problems Solved

AI Transcend built an intelligent claims processing and fraud detection platform powered by computer vision and machine learning. It automates damage assessment for faster, more accurate settlements while detecting suspicious claims to reduce losses and boost operational efficiency.

Key Features of the Solution

-

Computer Vision

for Damage Detection

-

Machine Learning

for Fraud Risk Scoring

Achievements and Benefits

45% Cost Savings

Substantial Cost Reduction:

A 45% improvement in automation significantly reduced reliance on manual assessments.

15x Speed Boost

Accelerated Efficiency Gains:

Claim processing speed improved by 15x, leading to a notable reduction in turnaround time.

85% Fraud Detection

Effective Fraud Prevention:

85% of fraudulent claims were identified within the top 20% of high-risk cases.

27% Improvement

Improved Settlement Rate:

The first-time settlement rate improved by 27%, rising from 55% to 82% post-implementation.

Optimize Your Claims and Fraud Operations

Ready to optimize your property insurance operations and enhance customer satisfaction? Connect with our insurance industry specialists to explore how AI Transcend can drive efficiency and profitability for your brand.

Auto Insurance Claims Automation

A Major Insurance Provider

Intelligent Claims Management and Risk Scoring Platform

The auto insurance sector faces relentless competition and rising customer expectations for speed and efficiency in claims processing.

Manual claim verification takes 2–3 days with just 60% accuracy, while legacy fraud systems miss 30% of fraudulent claims, driving dissatisfaction and financial losses.

Core Problems Solved

AI Transcend’s ML-driven solution automates claim risk scoring and prioritization, replacing manual reviews with data-driven triage. It fast-tracks low-risk claims, flags high-risk ones for review, and accelerates the claims lifecycle while enhancing fraud detection accuracy.

Key Features of the Solution

-

Advanced

Risk Scoring Model

-

Intelligent

Claims Triage System

Achievements and Benefits

65% AI Automation

Increased Automation:

Achieved a 65% uplift in automation, with AI now handling the majority of claims, substantially reducing manual review costs.

14x Time Reduction

Faster Processing Times:

Delivered a 14x reduction in the average processing time for claims, enhancing operational efficiency.

70% Fraud Detection

Fraud Prevention:

Successfully identified 70% of fraudulent claims in high-score cases, minimizing financial losses from fraud.

27% Settlement Uplift

27% Uplift First-Time Settlement Rate:

Improved the first-time settlement rate by 27%, from 45% to 72%, leading to higher customer satisfaction.

Transform Your Auto Claims Process

Ready to streamline your auto insurance claims? Connect with our specialists to discover how our intelligent automation platform can drive efficiency and accuracy.

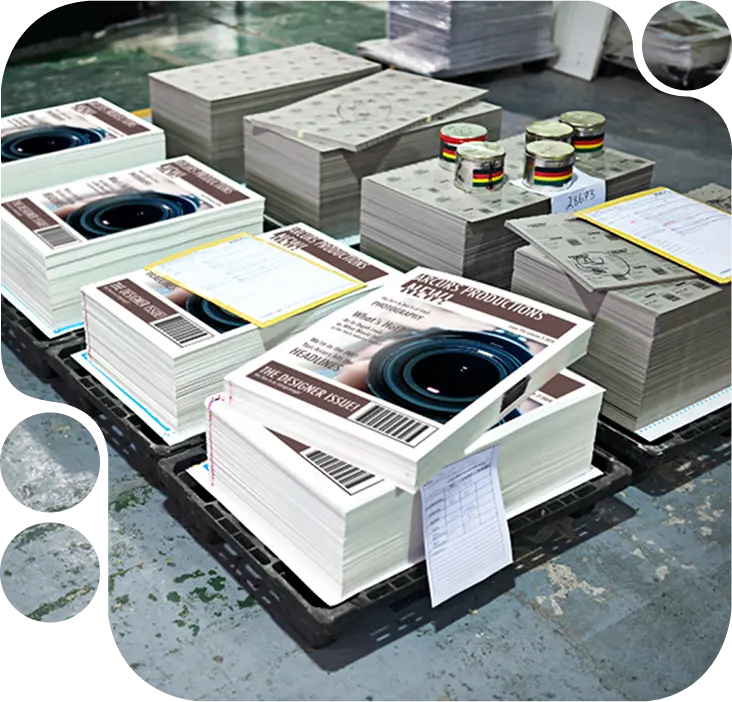

AIGC-Powered Product Launch Acceleration

A Leading Name in the Nation’s Property Insurance Industry

AI-Generated Content and Marketing Automation Platform

The insurance industry is evolving as firms seek to accelerate product launches while keeping marketing spend in check.

Manual content creation delays launches by 2–3 weeks, costs over $150,000 annually and introduces branding inconsistencies and compliance risks.

Core Problems Solved

AI Transcend’s client leverages AIGC technology to automate marketing content creation, cutting manual costs and inefficiencies. The solution accelerates product rollouts, ensures compliant and on-brand materials at scale, and allows marketing teams to focus on strategic initiatives.

Key Features of the Solution

-

AIGC-Driven Marketing

Content Generation

-

Automated Brand

and Compliance Assurance

Achievements and Benefits

80% Efficiency Gain

Content Production Efficiency:

Achieved an 80% reduction in the time required to manually create marketing and policy materials.

20% Cost Savings

Labor Cost Reduction:

Delivered a 20% reduction in labor costs associated with content creation through automation.

66% Faster

Time-to-Market Improvement:

Enabled a 66% faster time-to-market for new product launches, providing a significant competitive advantage.

Transform Your Product Launch Strategy

Ready to accelerate your go-to-market timeline? Connect with our AIGC experts to learn how automated content generation can revolutionize your product launches.

Swift Market Feedback with AIGC

A Trusted Leader in Property Insurance

Public Opinion and Brand Reputation Management Platform

Insurers are placing greater emphasis on protecting brand credibility and staying agile in addressing changing customer perceptions.

Traditional keyword monitoring misses 30% of negative feedback, triggers 20% false alarms, and requires over 40 hours weekly for manual analysis that captures only 60% of relevant data.

Core Problems Solved

AI Transcend’s client uses an advanced LLM to automate unstructured text analysis for real-time public opinion monitoring. Replacing manual keyword detection, the solution improves sentiment accuracy and enables proactive responses to market trends and reputational risks.

Key Features of the Solution

-

Advanced Sentiment

Analysis Engine

-

Automatic Related

Keyword Finder

-

Multi-Channel

Data Integration

Achievements and Benefits

30% Improvement

Negative Feedback Detection:

Achieved a 30% improvement in negative feedback detection, now successfully catching 92% of all relevant cases.

80% Efficiency Gain

Improved Operational Efficiency:

Delivered an 80% reduction in weekly analysis time, from 40 hours down to just 8 hours.

4x Reduction

Reduced False Alarm Rate:

Realized a 4x reduction in the false alarm rate, from 20% down to 5%, allowing teams to focus on genuine issues.

Transform Your Brand Management

Ready to protect and enhance your brand reputation? Connect with our analytics specialists to see how AI-powered market feedback can provide a competitive edge.

AIGC-Powered Operational Efficiency Improvement

A Well-Established Property Insurer

Operations and Anomaly Detection Platform

In the insurance industry, system reliability and rapid issue resolution are key to sustaining customer trust and performance.

Manual monitoring consumes 16+ hours weekly, with cross- department delays adding 4+ hours per issue, while anomaly detection takes 24–48 hours, causing costly downtime and revenue loss.

Core Problems Solved

AI Transcend’s client leverages a powerful LLM to automate complex IT operations, reducing manual workloads and boosting productivity. The solution performs root cause analysis, identifies system anomalies, and provides actionable insights to minimise downtime and enhance operational stability.

Key Features of the Solution

-

Multi-System

Data Integration

- Proactive Anomaly Detection Using Past Data

-

Automated Root

Cause Analysis

Achievements and Benefits

88% Efficiency Gain

Manual Checking Reduction:

Achieved an 87.5% reduction in the time supervisors spend checking work, from 16 hours down to just 2 hours.

20% Cost Savings

20% Savings Labor Cost Reduction:

Delivered a 20% projected annual reduction in operational labor costs through improved efficiency and process automation.

Transform Your IT Operations

Ready to enhance your operational efficiency and system reliability? Connect with our IT automation experts to learn how AIGC can transform your operations.